For many businesses, a Professional Employer Organization (PEO) provides valuable support with payroll, human resources, compliance, and employee benefits. However, as companies grow and evolve, they might find that transitioning out of a PEO and managing these functions in-house is a more strategic move. This transition can be complex and requires careful planning to ensure continuity of services and compliance. A benefits broker plays a critical role in facilitating this process, offering expertise and support to make the transition as smooth as possible.

In this blog, we’ll explore how a broker can assist your company in leaving a PEO, detailing the steps involved, the challenges you might face, and the benefits of working with a broker throughout the transition.

Understanding the Role of a PEO

Before diving into the transition process, it’s important to understand what a PEO does. A PEO provides a range of HR and administrative services under a co-employment arrangement. This typically includes:

- Payroll Administration: Handling employee paychecks, tax withholdings, and payroll processing.

- Benefits Management: Administering employee benefits such as health insurance, retirement plans, and other perks.

- Compliance Assistance: Ensuring that the company adheres to various employment laws and regulations.

- Human Resources Support: Offering HR services, including recruitment, employee training, and performance management.

When a company works with a PEO, the PEO assumes a significant portion of the HR and administrative responsibilities, which can be advantageous for many organizations. However, as companies scale or if their business needs change, they might choose to exit the PEO arrangement and manage these functions internally.

Reasons for Leaving a PEO

There are several reasons why a company might decide to leave a PEO:

- Cost Considerations: As companies grow, the cost of PEO services may become more significant, and it may be more cost-effective to manage HR functions in-house.

- Desire for Control: Managing HR and benefits internally provides greater control over these functions, allowing for more tailored solutions to meet specific organizational needs.

- Changes in Company Structure: Organizational changes, such as mergers or acquisitions, might necessitate a reevaluation of the PEO relationship.

- Employee Benefits: Companies might want to offer a different range of benefits or improve existing benefits, which might be more feasible outside of a PEO arrangement.

The Role of a Broker in the Transition Process

A benefits broker is a key ally in transitioning away from a PEO. Their expertise and support can help ensure that the process is efficient, compliant, and minimizes disruption. Here’s how a broker can assist:

1. Planning and Strategy Development

The transition from a PEO involves several strategic decisions. A broker can help your company plan the transition by:

- Assessing Current Benefits and HR Needs: A broker will review your current benefits and HR setup under the PEO to understand what’s working well and what needs improvement.

- Developing a Transition Plan: They can help create a comprehensive plan for the transition, including timelines, key milestones, and responsibilities.

- Evaluating In-House Capabilities: The broker can assist in assessing your internal resources and capabilities to manage HR functions post-transition.

2. Employee Benefits Management

One of the most critical aspects of leaving a PEO is managing employee benefits. A broker plays a crucial role in this area by:

- Reviewing and Selecting New Benefits Plans: A broker will help you evaluate and select new health insurance plans, retirement plans, and other employee benefits that align with your company’s needs and budget.

- Ensuring Continuity of Coverage: They will work to ensure that there is no disruption in employee benefits coverage during the transition, which is vital for maintaining employee satisfaction and compliance.

- Communicating with Employees: Brokers can assist in communicating changes to employees, explaining new benefits options, and addressing any concerns they may have.

3. Compliance and Risk Management

Compliance with employment laws and regulations is critical, especially during a transition. A broker helps manage this by:

- Ensuring Regulatory Compliance: They will ensure that your new benefits plans and HR processes comply with federal, state, and local regulations, including ERISA, the Affordable Care Act (ACA), and other applicable laws.

- Managing Risk: The broker can help identify potential risks associated with the transition and develop strategies to mitigate these risks.

- Handling Documentation and Reporting: They assist with the preparation and submission of required documentation and reports, such as Form 5500 filings for employee benefit plans.

4. Vendor Selection and Negotiation

Choosing the right vendors and negotiating favorable terms is a key part of the transition process. A broker provides support by:

- Identifying Suitable Vendors: They will help identify and evaluate potential vendors for benefits administration, payroll processing, and other HR functions.

- Negotiating Contracts: Brokers can negotiate terms and pricing with vendors to ensure that you secure the best possible deals for your company.

- Managing Vendor Relationships: They can assist in managing relationships with new vendors and ensuring that services are delivered as promised.

5. Implementation and Training

Successful implementation of new benefits and HR systems requires careful coordination. A broker helps by:

- Overseeing Implementation: They will manage the implementation of new benefits plans and HR systems, ensuring that everything is set up correctly and functioning smoothly.

- Providing Training: The broker can arrange training for your HR staff on new systems and processes, helping them get up to speed quickly and efficiently.

- Monitoring and Support: They offer ongoing support during the initial stages of the transition to address any issues and ensure that the new systems are working as intended.

Key Considerations During the Transition

When transitioning from a PEO, there are several key considerations to keep in mind:

1. Timing

Timing is crucial to ensure a smooth transition. Plan the move carefully to avoid disruptions in benefits coverage or HR operations. Consider the timing of open enrollment periods, plan year end dates, and other relevant factors.

2. Employee Communication

Effective communication with employees is essential. Provide clear information about the upcoming changes, including details about new benefits options, how to access these benefits, and any actions they need to take.

3. Data Migration

Accurate data migration is critical for ensuring continuity and compliance. Ensure that all employee data, benefits information, and other relevant records are transferred correctly to the new systems.

4. Legal and Regulatory Compliance

Ensure that all aspects of the transition comply with legal and regulatory requirements. Work closely with your broker and legal advisors to address any compliance issues and avoid potential pitfalls.

5. Employee Experience

Consider the impact of the transition on employee experience. Aim to make the transition as seamless as possible and address any concerns or questions employees may have.

Challenges and Solutions

Transitioning from a PEO can present several challenges. Here are some common challenges and how a broker can help address them:

1. Benefits Coverage Gaps

Challenge: There may be gaps in benefits coverage during the transition period.

Solution: A broker can work to ensure that new benefits plans are in place before the PEO arrangement ends, minimizing any gaps in coverage.

2. Complex Compliance Issues

Challenge: Managing compliance with regulations can be complex and overwhelming.

Solution: Brokers have expertise in compliance and can guide you through the regulatory landscape, ensuring that your new benefits plans and HR processes meet all legal requirements.

3. Employee Concerns

Challenge: Employees may have concerns about changes to their benefits or HR services.

Solution: Brokers can help address these concerns by providing clear communication, answering questions, and offering support throughout the transition.

4. Vendor Selection

Challenge: Choosing the right vendors for benefits administration and HR functions can be challenging.

Solution: A broker can assist in evaluating and selecting vendors, negotiating contracts, and managing vendor relationships to ensure that you get the best possible services.

Case Study: Successful Transition from a PEO

To illustrate the process, let’s look at a case study of a company that successfully transitioned from a PEO with the help of a broker.

Company Background

ABC Corporation, a mid-sized technology company, decided to leave its PEO after five years. The company had grown significantly and wanted more control over its HR functions and benefits offerings. The decision was driven by a desire to tailor benefits to the needs of its expanding workforce and reduce costs.

The Transition Process

- Planning: ABC Corporation worked with a broker to develop a comprehensive transition plan. This included assessing current benefits, evaluating in-house capabilities, and setting a timeline for the move.

- Benefits Management: The broker helped ABC Corporation review and select new health insurance and retirement plans. They ensured that there was no disruption in employee benefits coverage and communicated the changes effectively to employees.

- Compliance: The broker assisted with ensuring compliance with ERISA, ACA, and other regulations. They prepared and submitted all required documentation and reports.

- Vendor Selection: The broker identified and negotiated with new vendors for benefits administration and payroll processing. They managed vendor relationships and ensured that services were delivered as promised.

- Implementation: The broker oversaw the implementation of new benefits plans and HR systems. They provided training for HR staff and offered ongoing support during the transition.

Results

The transition was successful, with minimal disruption to employee benefits and HR operations. Employees were satisfied with the new benefits options, and the company achieved cost savings and improved control over HR functions.

Conclusion

Leaving a PEO is a significant decision that requires careful planning and execution. A benefits broker plays a vital role in facilitating this transition, offering expertise and support to ensure a smooth and successful move. From planning and benefits management to compliance and vendor selection, a broker’s assistance can help your company navigate the complexities of the transition and achieve your HR and benefits goals.

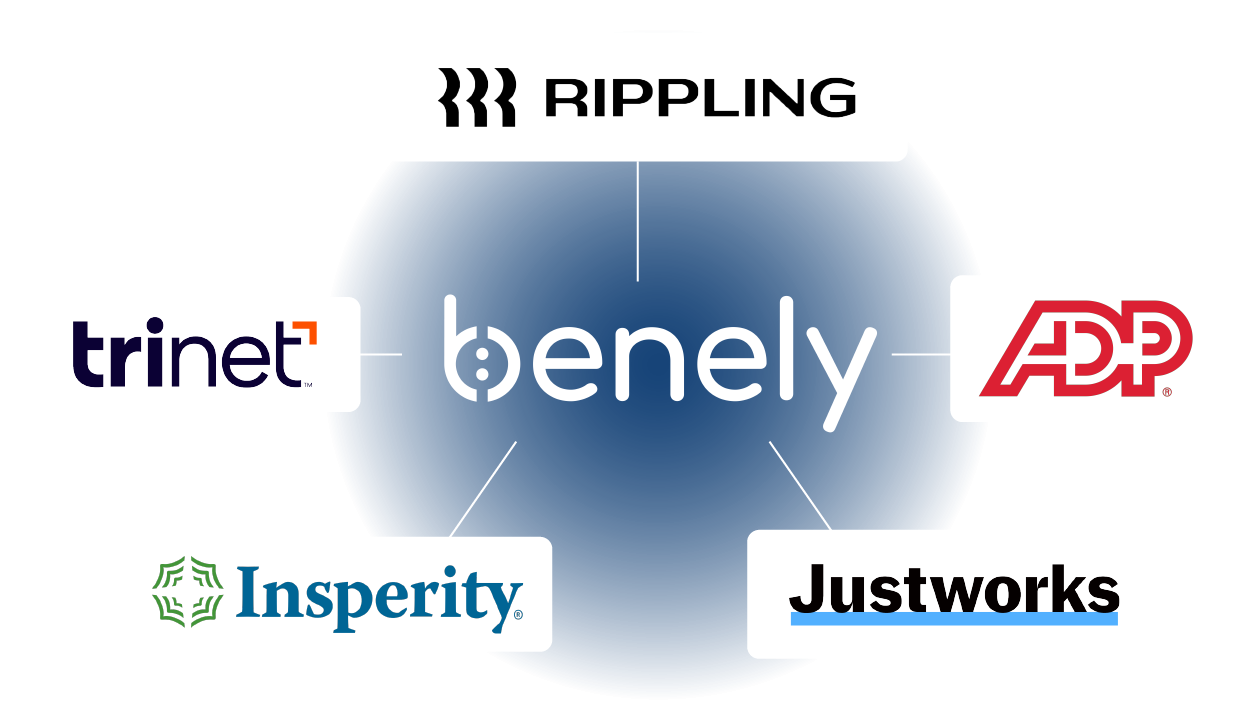

By working with a broker, you can ensure that your transition from a PEO is well-managed, compliant, and aligned with your company’s strategic objectives. With the right support, your company can move forward with confidence, benefiting from enhanced control over HR functions and a benefits package tailored to meet the needs of your employees. Benely can help with PEO transitions, let’s connect.